If you’re looking to boost your business finances, I recommend exploring the 15 best budgeting planners designed specifically for entrepreneurs. These planners combine durability, flexible layouts, and goal-focused features like expense tracking, bill organizing, and motivational elements. From undated options to all-encompassing monthly and weekly layouts, they help you stay organized and focused. Keep going to discover detailed insights on choosing the perfect planner to fit your unique needs and grow your business finances.

Key Takeaways

- Look for planners with comprehensive expense, income, and goal-tracking sections tailored for small business and entrepreneurial needs.

- Prioritize durable, high-quality materials like eco-leather covers and thick paper to ensure longevity and smooth writing.

- Choose undated and customizable layouts that allow flexible start dates and personalized financial planning.

- Opt for planners with motivational features, reflection prompts, and law of attraction elements to foster positive money habits.

- Consider portability and additional accessories like receipt pockets, bookmarks, and goal sections for practical, on-the-go business management.

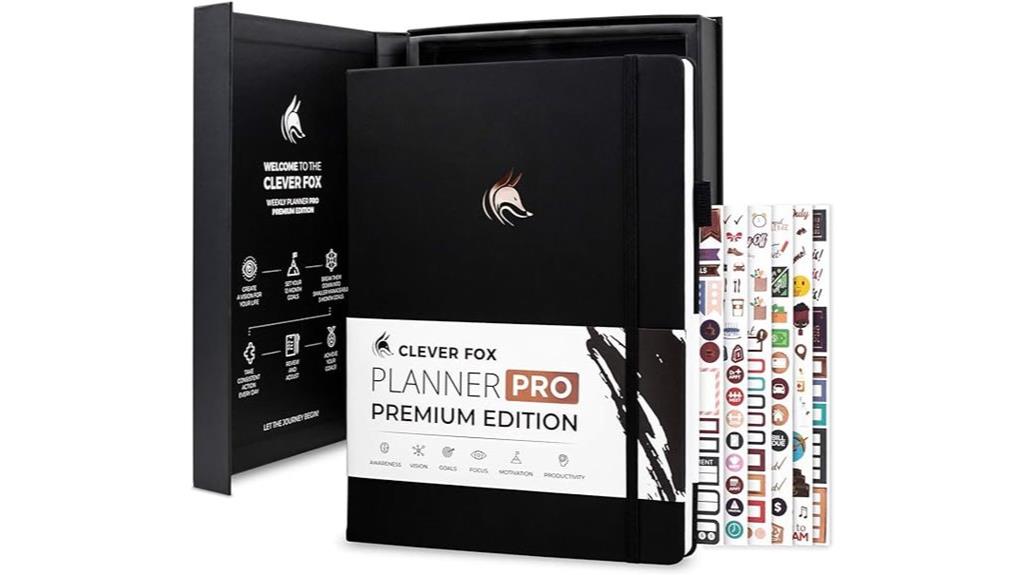

Clever Fox Planner Pro Premium A4 Black

If you’re an entrepreneur looking for a stylish, versatile planner that keeps your finances on track, the Clever Fox Planner Pro Premium A4 Black is an excellent choice. Its undated format lets you start anytime, and the spacious layouts for weekly, monthly, and financial planning help you stay organized. The eco-leather hardcover and thick 120gsm paper provide durability and a premium feel. Features like the lay-flat binding, elastic band, pen loop, and multiple bookmarks make daily use effortless. Plus, the included stickers and user guide enhance your planning experience. Overall, this planner combines elegance and practicality, making it perfect for managing both your goals and your budget.

Best For: entrepreneurs and professionals seeking a stylish, versatile planner to manage their goals and finances with ease and elegance.

Pros:

- Undated format allows flexible start dates without waste of pages

- Premium features like eco-leather hardcover, thick 120gsm paper, and lay-flat binding enhance durability and usability

- Includes useful accessories such as stickers, a user guide, multiple bookmarks, and a gift box for an upgraded planning experience

Cons:

- A4 size may be too large for those preferring compact planners

- Premium materials and features come at a higher price point

- Limited to users who need extensive space for weekly, monthly, and financial planning

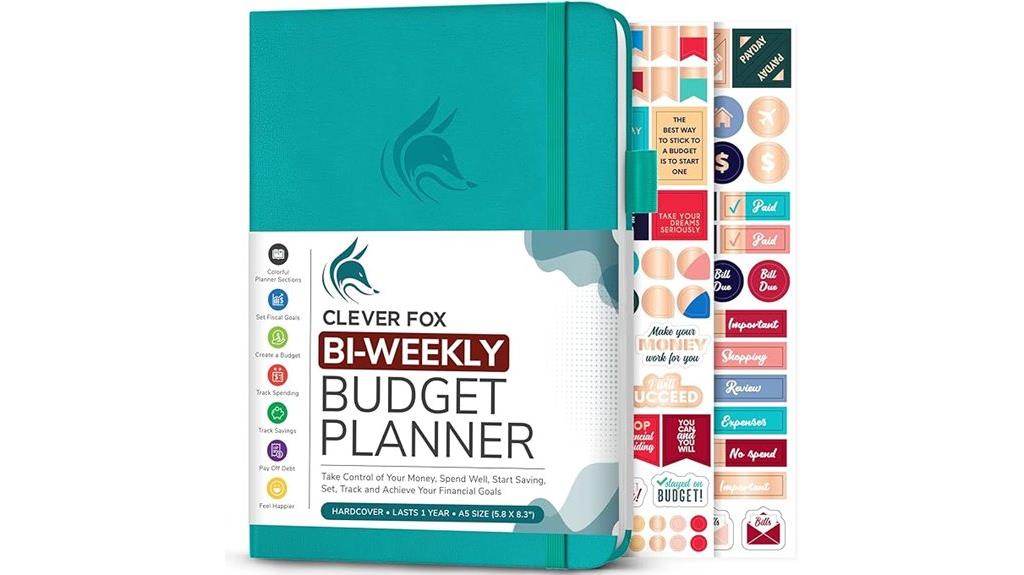

Clever Fox Bi Weekly Budget Planner, Undated Financial Organizer Book

The Clever Fox Bi Weekly Budget Planner stands out as an ideal choice for entrepreneurs who need a flexible, detailed financial organizer that aligns with their irregular income and payment schedules. Its undated 12-month layout allows me to start anytime, while the bi-weekly sections help track expenses and pay periods accurately. The compact A5 size makes it portable, and features like thick pages, a pen loop, and elastic band add durability. With dedicated pages for goals, net worth, and debt management, I can easily monitor progress and stay organized. Customers praise its quality and flexibility, making it a reliable tool to boost financial control and planning.

Best For: entrepreneurs and individuals seeking a flexible, detailed financial organizer that accommodates irregular income and payment schedules with bi-weekly tracking.

Pros:

- Undated layout offers flexibility to start anytime of the year

- Durable materials like thick pages, faux leather cover, and additional features such as pen loop and elastic band

- Supports comprehensive financial goal setting, including net worth estimation and debt management

Cons:

- Some users find the absence of monthly calendar pages limiting for broader overview

- Pencil erasing may not completely disappear, affecting neatness

- The compact size, while portable, may be less ideal for users who prefer larger writing space

Financial Planner – Monthly Budget & Bill Organizer

Designed with entrepreneurs in mind, the Financial Planner’s Monthly Budget & Bill Organizer offers a thorough set of tools to help manage cash flow effectively. Its undated format, thick 144 pages, and high-quality lay-flat binding make planning effortless. It features monthly overviews, expense, debt, and savings trackers, plus a bill organizer with pockets to streamline payments. The planner also includes goal-setting sections based on millionaire strategies and law of attraction principles, encouraging mindset shifts toward financial success. With colorful affirmations, stickers, and practical sheets, it promotes healthy financial habits, reduces stress, and keeps you focused on your goals—all in one organized, inspiring package.

Best For: Entrepreneurs, professionals, and individuals seeking an organized, inspiring way to manage finances, set goals, and develop healthy financial habits.

Pros:

- Undated format allows flexible planning without time restrictions

- Includes comprehensive trackers and bill organizer to streamline money management

- Features motivational affirmations and goal-setting tools based on millionaire strategies

Cons:

- May be too detailed for users preferring minimalist planning

- Thick 144 pages could be cumbersome for some users to carry around regularly

- Designed primarily for those interested in law of attraction and mindset shifts, which may not appeal to everyone

GoGirl Budget Planner, Monthly Financial Organizer and Expense Tracker

The GoGirl Budget Planner stands out for entrepreneurs seeking a flexible, compact tool to manage their finances on the go. Its undated format and durable eco-leather cover make it versatile and stylish. Measuring just 5.3×7.7 inches, it fits easily into a purse, perfect for daily tracking, goal setting, and holiday expense planning. The thick 120gsm pages prevent ink bleed-through, and features like a pen loop, elastic band, and receipt pocket add convenience. Users love its simple layout, high-quality construction, and ability to foster consistent budgeting habits. Overall, it’s an effective, portable organizer that balances structure with flexibility for busy entrepreneurs.

Best For: busy entrepreneurs and individuals seeking a stylish, portable, and flexible tool to manage their personal finances on the go.

Pros:

- Compact size fits easily into purses for daily use

- Durable eco-leather cover and thick 120gsm pages prevent ink bleed-through

- Undated format allows flexible start times and personalized budgeting

Cons:

- Limited space for detailed expense notes and extensive entries

- Some users find the pages stiff, making writing slightly challenging

- Layout separation between goals and weekly pages may feel disjointed for some users

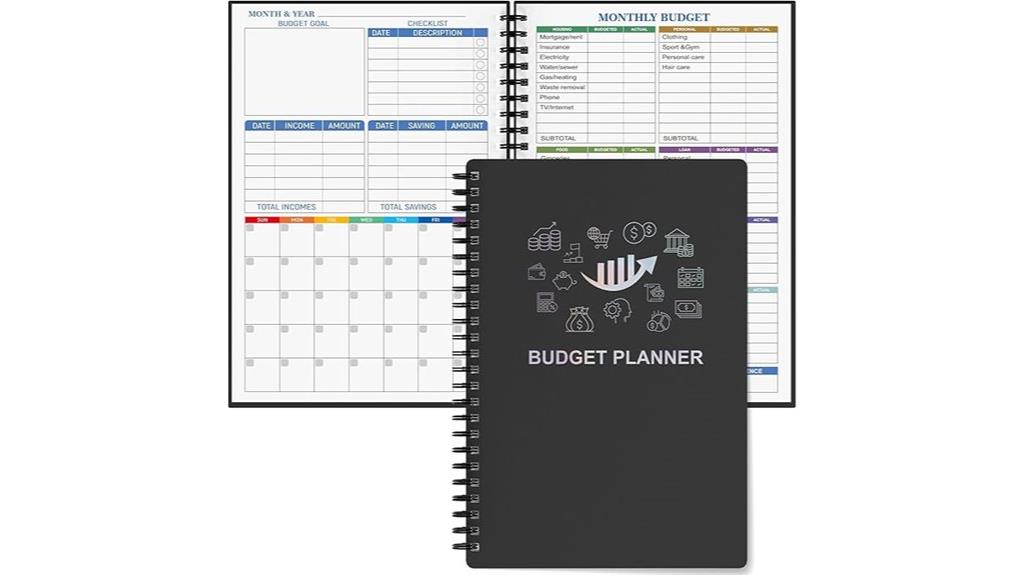

Budget Planner, Monthly Finance Organizer with Expense Tracker Notebook

If you’re an entrepreneur looking for a practical way to stay on top of your finances, this Budget Planner and Monthly Finance Organizer could be just what you need. It features sections for setting financial goals, tracking expenses, managing savings, and reviewing progress, helping you stay organized and focused. Its undated, flexible layout means you can start anytime, and its compact size (8.6×5.9 inches) fits easily into your bag. Made with high-quality paper and a sturdy, flexible cover, it’s built to last. With tools to develop good habits and strategies, this planner supports your journey toward financial independence over the course of a year.

Best For: entrepreneurs and individuals seeking an organized, portable, and flexible tool to manage their finances and achieve long-term financial goals.

Pros:

- Undated and flexible layout allows for year-round, customizable use.

- Compact size (8.6×5.9 inches) ensures easy portability and storage.

- High-quality 100gsm paper and sturdy cover enhance durability and a premium feel.

Cons:

- May require additional tools or software for more complex financial tracking.

- Limited space per section might not suit users with extensive expense tracking needs.

- The absence of pre-dated calendars means less immediate structure for long-term planning.

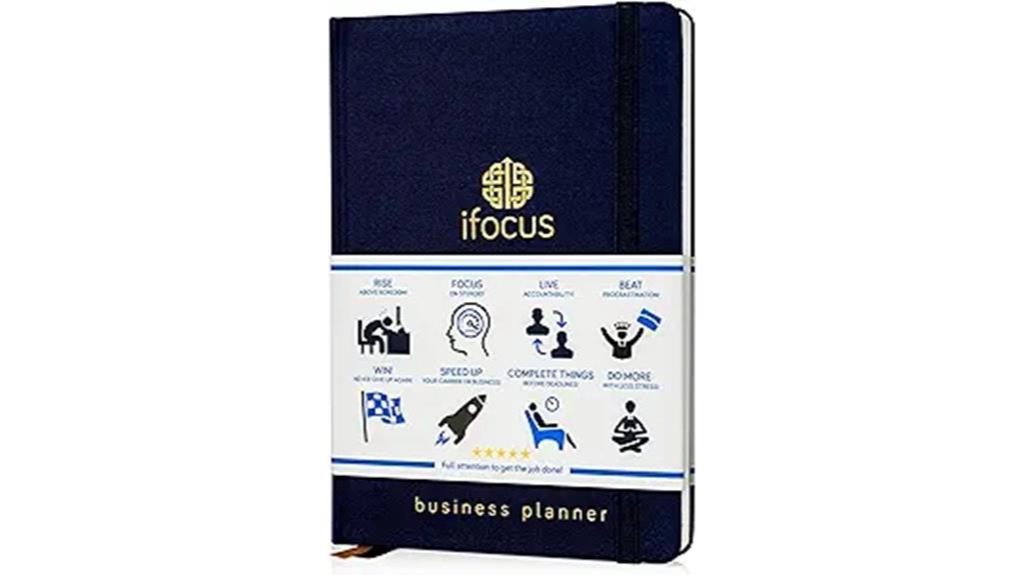

Business Planner Undated for Entrepreneurs

Are you an entrepreneur looking for a flexible planning tool that adapts to your evolving business goals? The ifocus Business Planner undated is perfect for you. Its compact A5 size makes it portable, while the leather cover adds a professional touch. Designed to boost productivity, it helps break down three-month goals into actionable steps across monthly, weekly, and daily sections. Although it requires dedication to use effectively, many users praise its strategic approach to organizing tasks and staying focused. Keep in mind, some design quirks like light ink and binding limitations may affect comfort, but overall, this planner offers a customizable, goal-oriented system to elevate your business planning.

Best For: entrepreneurs and business owners seeking a structured, goal-oriented planner to enhance focus, organization, and strategic task management.

Pros:

- Compact A5 size makes it highly portable and easy to carry around.

- Helps break down three-month goals into actionable steps across multiple planning sections.

- Encourages purpose-driven planning and strategic focus for business growth.

Cons:

- Light-colored ink can make text difficult to read on certain pages.

- Binding style and elastic band may interfere with laying the planner flat for writing.

- Requires significant time commitment and dedication to fully utilize its detailed structure.

ZICOTO Monthly Budget Planner and Expense Tracker

For entrepreneurs seeking a flexible, all-in-one tool to manage their finances, the ZICOTO Monthly Budget Planner and Expense Tracker stands out as an ideal choice. Its undated, compact design makes it easy to start anytime and carry everywhere. The planner offers a clean, minimalistic layout that combines tracking income, expenses, savings, debts, and bills, along with setting financial goals. Extras like motivational quotes, stickers, and special trackers keep you motivated and organized. With its exhaustive approach and user-friendly format, it helps streamline your financial planning, making it easier to stay on top of your budget and achieve your long-term business goals.

Best For: entrepreneurs and individuals seeking a versatile, easy-to-use, and comprehensive budget planner to manage income, expenses, savings, debts, and financial goals with flexibility and style.

Pros:

- Undated format allows flexible start times and ongoing use throughout the year

- Compact size and durable materials make it portable and long-lasting

- Includes motivational quotes, stickers, and trackers to enhance engagement and organization

Cons:

- Limited space for detailed daily entries may require additional tools for extensive tracking

- May be less suitable for those preferring digital budgeting solutions or highly detailed accounting

- Some users might find the minimalistic design too simple for complex financial planning needs

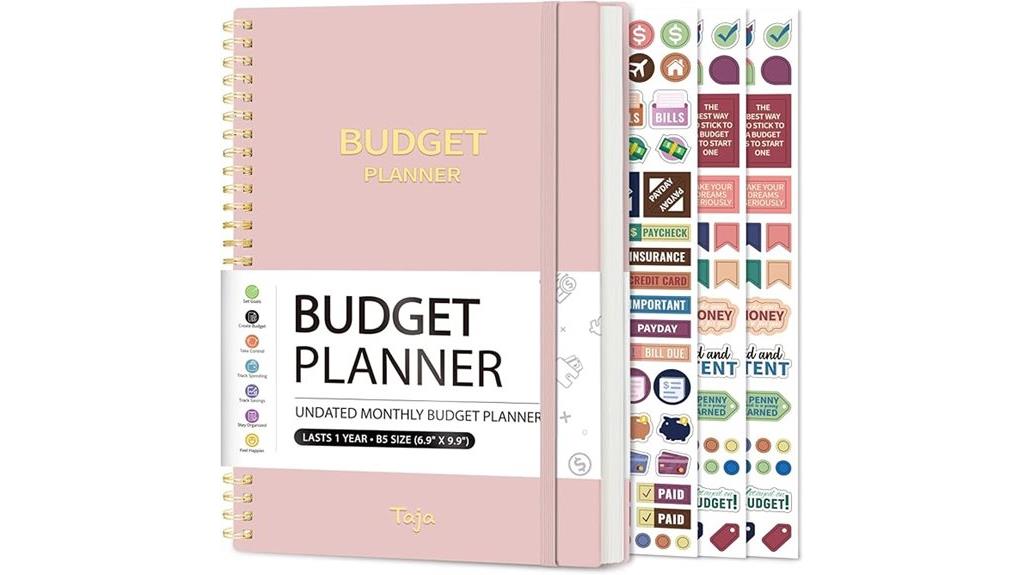

Budget Planner, Monthly Expense & Finance Organizer Notebook

Looking for a budgeting tool that keeps your finances organized and easily accessible? The Budget Planner 2025-2026 is a thorough, undated monthly notebook designed for entrepreneurs. It combines expense tracking, income planning, savings, debt management, and bill organization in one user-friendly format. With full-page calendars, goal-setting sections, and bill pay trackers, it simplifies financial oversight. Its durable cover, bonus stickers, and included guidebook make budgeting engaging and practical. Rated highly for quality and customization, this planner helps you stay on top of your finances effortlessly, whether you’re just starting or looking to refine your financial strategy.

Best For: entrepreneurs and small business owners seeking a comprehensive, durable, and customizable budgeting tool to manage their finances effectively.

Pros:

- All-in-one planner that combines expense tracking, income planning, savings, debt management, and bill organization in one accessible format

- Durable, water-resistant cover with bonus stickers and a comprehensive guidebook for an engaging budgeting experience

- Full-page monthly calendars with space for paydays, bills, and appointments, making it easy to stay organized and on top of financial deadlines

Cons:

- Front page requests for personal information, including social security number, which may raise privacy concerns

- Lacks page tabs for easier navigation through different sections of the planner

- Undated format requires manual date entry each month, which may be less convenient for some users

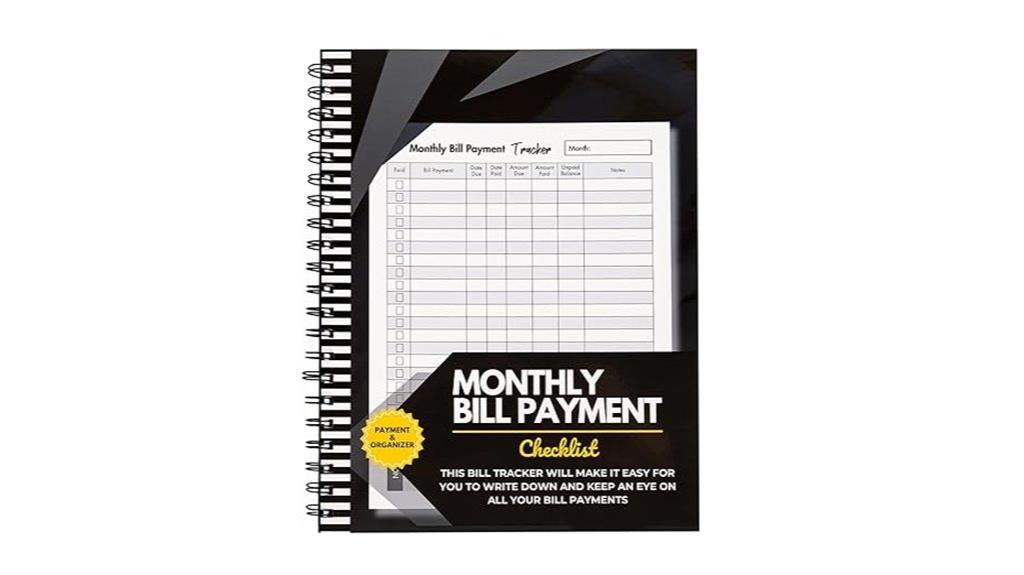

Bill Tracker Notebook with Spiral Binding, 8.5 x 11, 132+ Pages

This Bill Tracker Notebook with Spiral Binding is an excellent choice for entrepreneurs who prefer manual record-keeping and need a clear, organized way to manage their bills. Sized at 8.5 x 11 inches with over 132 pages, it provides ample space for tracking payment details, due dates, amounts, and status checks. The spiral binding makes flipping pages easy, while larger rows simplify data entry. Its quality paper resists bleeding, ensuring durability. Perfect for households or small teams, this notebook keeps bills organized and accessible at a glance. Many users find it more efficient than digital methods, making it a practical, reliable tool for staying on top of finances.

Best For: entrepreneurs and households seeking a manual, organized way to track and manage bills efficiently with ample space and durable quality.

Pros:

- Spacious 8.5 x 11 inch pages with over 132 pages for comprehensive tracking

- Spiral binding allows easy flipping and writing on pages

- High-quality paper resists bleeding, suitable for markers and pens

Cons:

- May be too large for users preferring compact organizers

- Manual entry requires ongoing effort, less convenient than digital tools

- Not suitable for those who prefer digital or automated bill management systems

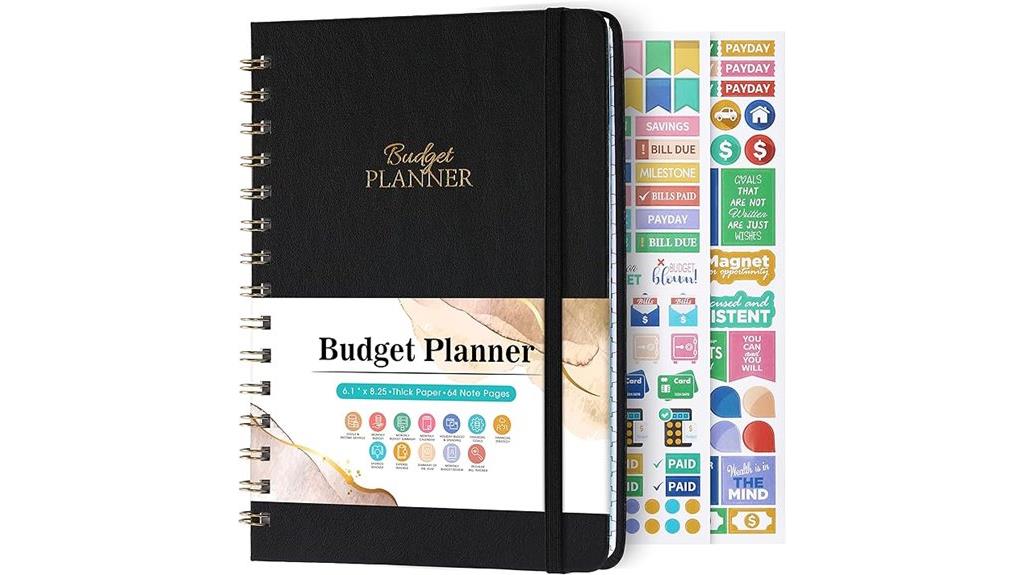

Budget Planner with Bill Organizer and Expense Tracker

If you’re seeking a practical tool to streamline bill management and expense tracking, the Budget Planner with Bill Organizer and Expense Tracker stands out as an ideal choice. This undated 12-month planner helps you stay on top of your finances by organizing bills, tracking expenses, and setting goals. Its thoughtful design includes monthly budgets, reviews, and notes, all in a portable 6.1 x 8.25-inch size. With features like a durable cover, thick archival paper, and an inner pocket, it’s perfect for entrepreneurs who want to develop better financial habits and improve their money management over time. Rated highly, it’s a reliable, user-friendly tool.

Best For: individuals and entrepreneurs seeking an effective, portable tool to organize bills, track expenses, and develop better financial habits over a year.

Pros:

- Durable cover and thick archival-quality paper ensure longevity and resistance to damage.

- Portable size (6.1 x 8.25 inches) makes it easy to carry and use on the go.

- Comprehensive features including monthly budgets, reviews, and goal-setting promote disciplined money management.

Cons:

- Lacks pre-printed dates, which may require manual entry and could be inconvenient for some users.

- Limited space for free text and detailed notes might restrict thorough tracking for advanced users.

- Only available in the undated format, so users must be disciplined to start and maintain their schedule.

Paycheck Budget Planner, Financial Organizer for Budgeting and Expense Tracking

The Paycheck Budget Planner stands out as an ideal tool for entrepreneurs who need flexible, easy-to-use expense tracking that adapts to their irregular schedules. Its undated format lets you start anytime and reuse it year after year, fitting weekly, bi-weekly, or monthly pay cycles. Made with thick, 120gsm premium paper, it prevents ink bleed-through for smooth writing. It offers detailed sections for income, savings, bills, expenses, and debt repayment, along with over 25 expense trackers, goal-setting areas, and progress reflections. Plus, it includes a step-by-step guide to help you maximize your budgeting effectiveness effortlessly.

Best For: Entrepreneurs and freelancers seeking flexible, comprehensive expense tracking and budgeting tools tailored to irregular schedules and pay cycles.

Pros:

- Undated format allows for flexible start dates and yearly reuse.

- Thick 120gsm premium paper prevents ink bleed-through for a smooth writing experience.

- Extensive features including over 25 expense trackers, goal-setting sections, and a step-by-step budgeting guide.

Cons:

- May require some initial setup time to customize according to individual financial situations.

- Not specifically designed for digital users who prefer electronic budgeting tools.

- Limited to physical format, which might be less convenient for those who prefer mobile or online access.

Bill Payment Tracker Notebook for Budgeting & Finances

For entrepreneurs seeking a reliable way to manage their bills and finances, the Bill Payment Tracker Notebook offers a practical solution. Its compact A5 size makes it easy to carry and review, helping you avoid missed payments and discrepancies. Crafted with durable, high-quality materials, it features waterproof cover, thick paper, and an elastic closure for durability. With 112 undated pages, it provides clear layouts for tracking bills, due dates, payments, and notes. The built-in calendar and holiday planner help schedule payments around busy periods, reducing late fees. Versatile and user-friendly, this notebook streamlines financial management and promotes better budgeting habits.

Best For: entrepreneurs and busy individuals seeking an organized, reliable way to track bills, manage finances, and schedule payments efficiently.

Pros:

- Compact and portable design for easy on-the-go use and review.

- Durable construction with waterproof cover and thick paper prevents damage and ink bleed-through.

- Built-in calendar and holiday planner aid in scheduling payments to avoid late fees.

Cons:

- Limited to 112 undated pages, which may require additional notebooks for extensive tracking.

- Not equipped with digital features or integrations for automatic reminders.

- May be less suitable for those preferring electronic or app-based financial management systems.

Budget Planner with Monthly Tabs, Hardcover

A hardcover, large-sized budget planner with monthly tabs offers entrepreneurs a durable and organized way to manage their finances throughout the year. I love its sturdy vegan leather cover and vibrant purple color, which make it both stylish and resilient. The 7 x 10-inch size fits comfortably in my bag, and features like the elastic band, pen holder, and back pocket for receipts boost convenience. Its thick, no-bleed paper and user-friendly layout simplify tracking expenses, setting goals, and reviewing progress. With monthly tabs and detailed sections, it helps me stay on top of cash flow, debts, and savings, turning financial management into a straightforward, effective routine.

Best For: entrepreneurs and individuals seeking a durable, stylish, and comprehensive tool for year-round financial management and expense tracking.

Pros:

- Durable hardcover vegan leather cover with vibrant purple color for style and longevity

- Thick 100gsm no-bleed paper and user-friendly layout simplify expense tracking and goal setting

- Includes practical features like elastic band, pen holder, and back pocket for receipts, enhancing convenience

Cons:

- Large size (7 x 10 inches) may be less portable for some users who prefer smaller planners

- Limited to 12 months, requiring purchase of a new planner annually for continued use

- May be priced higher due to premium materials and comprehensive features

Legend Planner Weekly & Monthly Life Planner (A5 Black)

If you’re an entrepreneur seeking an all-encompassing planning tool, the Legend Planner Weekly & Monthly Life Planner (A5 Black) stands out because of its detailed goal-setting and habit-tracking features. I find its undated format flexible, allowing me to start anytime and customize my planning. The durable faux leather cover, thick non-bleed paper, and lay-flat design make it practical for daily use. It offers weekly and monthly overviews, reflection prompts, and dedicated sections for goals and habits—perfect for staying organized and motivated. With its sleek look and comprehensive features, it helps me maintain focus on my personal and business growth throughout the year.

Best For: entrepreneurs and goal-oriented individuals seeking a comprehensive, customizable planner to organize personal and professional growth throughout the year.

Pros:

- Undated format allows flexible start dates and customized planning.

- High-quality materials including thick, bleed-resistant paper and durable faux leather cover.

- Extensive features such as goal-setting sections, habit trackers, reflection prompts, and monthly/weekly overviews for thorough organization.

Cons:

- Requires initial effort to fill in dates, which may be time-consuming.

- Some users might find the detailed structure overwhelming if they prefer minimal planning tools.

- As a thicker, more comprehensive planner, it may be less portable for those seeking a lightweight option.

Clever Fox Budget Book 2.0 Budgeting Planner for Beginners

The Clever Fox Budget Book 2.0 stands out as an ideal choice for beginners seeking a straightforward, portable financial planner. Its compact size makes it easy to carry everywhere, while the vibrant design keeps budgeting engaging. I appreciate how it simplifies monthly planning with dedicated sections for budgets, goals, bills, and expenses. The detailed trackers for savings, debt, and bills help me stay organized and monitor progress effortlessly. Plus, the premium eco-leather cover, quality paper, and helpful features like a pen loop and receipt pocket make it practical. With a 60-day satisfaction guarantee, it’s a reliable tool to kickstart your money management journey.

Best For: beginners and individuals seeking a portable, easy-to-use budgeting planner to manage their personal finances effectively.

Pros:

- Compact and portable size makes it easy to carry everywhere.

- Vibrant, colorful pages enhance engagement and motivation.

- Comprehensive features include budget planning, goal setting, and detailed trackers for savings, debt, and bills.

Cons:

- Limited space may not suit users with complex or extensive financial needs.

- Might require additional tools or apps for in-depth financial analysis.

- Premium eco-leather cover could be less durable over long-term use compared to hardcover binders.

Factors to Consider When Choosing Budgeting Planners for Entrepreneurs

When selecting a budgeting planner, I focus on how well it matches my financial goals and daily needs. I also consider its layout flexibility, durability, size, and the tools it offers for tracking progress. These factors help me choose a planner that keeps me organized and motivated to grow my business.

Financial Goal Alignment

Choosing a budgeting planner that aligns with your financial goals is essential for entrepreneurial success. I look for planners with sections tailored to both short-term milestones and long-term objectives, like scaling my business or increasing profit margins. It’s important they include tools for tracking progress toward targets such as revenue growth or expense reduction, so I stay focused on my priorities. Customizable goal categories are a plus, allowing me to reflect my unique industry expenses and personal ambitions. I also prefer planners that offer space for strategic planning, like cash flow management and investment goals, which are crucial for sustainability. Finally, reflection and review prompts help me assess my progress regularly and adjust strategies, ensuring I stay on track toward my financial aspirations.

Layout Flexibility

A flexible layout is essential because it allows me to adapt my budgeting planner to my evolving business needs. I appreciate planners with undated pages, so I can start anytime without wasting pages or feeling locked into a calendar. Modular or customizable pages give me the freedom to add, remove, or rearrange sections like project budgets or cash flow tracking, aligning the planner with my current priorities. Having both monthly overviews and weekly detail pages helps me balance big-picture planning with daily financial management. Additionally, the ability to incorporate notes, reflections, or goal-setting pages makes the planner more adaptable as my business grows and changes. This flexibility ensures my planner remains useful, relevant, and tailored to my specific journey.

Material Durability

Durable materials are essential because they guarantee my budgeting planner can withstand daily use without falling apart. Thick 120gsm paper prevents tearing and ensures smooth writing, even with frequent handling. A sturdy cover made of eco-leather or waterproof material protects against spills, stains, and environmental damage, keeping my planner looking professional longer. High-quality binding, like lay-flat or twin-wire, keeps pages securely intact and easy to manage during planning sessions. Reinforced edges and strong binding materials reduce the risk of pages tearing or detaching over time. Additionally, fade-resistant printing maintains clarity and professionalism despite frequent handling. Investing in a planner with resilient materials saves money in the long run and ensures my financial planning stays consistent and reliable, no matter how hectic my schedule gets.

Size and Portability

Have you ever struggled to carry a bulky planner during busy days? Choosing a compact size, like A5 or smaller, makes it easier to stay organized on the go. A lightweight design means I can manage my planner without it adding unnecessary bulk to my bag or briefcase. I look for planners with durable covers and binding options like spiral or lay-flat, which make writing comfortable in any setting. It’s also important that the planner fits seamlessly into my daily carry items, whether it’s a purse, backpack, or briefcase. I aim for a size that offers enough space for detailed entries but remains manageable for regular use. The right size helps me stay consistent and accessible, even during hectic schedules.

Tracking and Monitoring Tools

Choosing a planner that effectively tracks and monitors your financial progress is key to staying on top of your business budget. Look for tools with expense trackers, income logs, and debt payoff sheets to accurately observe cash flow. Regularly updated monitoring sections help identify spending patterns early, so you can adjust your budget proactively. Features like goal-setting pages and progress charts make it easier to visualize your financial milestones over time, keeping you motivated. Integration of budget review prompts and reflection spaces encourages ongoing evaluation and improvement of your financial strategies. Additionally, clear categorization and customizable templates ensure the planner fits your specific business needs, making tracking less cumbersome and more effective in helping you maintain control over your finances.

Design and Aesthetics

Since I’ll be using my budgeting planner regularly, it’s important that its design appeals to my personal style and keeps me motivated. A visually appealing planner with a clean, organized layout makes tracking finances easier and less overwhelming. Clear sections and intuitive flow help me find what I need quickly, reducing confusion. High-quality materials like thick paper and a durable cover not only look good but also stand up to daily use. Adding motivating elements such as stickers, color coding, or inspiring quotes can make budgeting more enjoyable and help me stay engaged. Ultimately, the overall aesthetic—font choice, color scheme, and cover design—should resonate with my preferences, fostering a sense of ownership and encouraging consistent use.

Budgeting Method Compatibility

Selecting a budgeting planner that aligns with my preferred method is essential for staying organized and motivated. I look for a layout that matches my approach, whether it’s zero-based, envelope system, or 50/30/20 rule. It’s important that the planner has dedicated sections for cash flow, expense categorization, or savings goals that suit my style. I also check if its tracking tools support my method, like expense trackers for cash envelopes or goal pages for targeted savings. Additionally, I consider whether features like weekly or monthly reviews help me stay consistent. Ultimately, I prefer planners that are either undated or dated, depending on how flexible my planning routine is. Choosing a compatible planner keeps my financial management straightforward and aligned with my goals.

Frequently Asked Questions

How Do I Choose a Budgeting Planner Suitable for My Business Size?

When choosing a budgeting planner, I focus on my business size and needs. For small startups, I prefer simple, user-friendly options that track expenses easily. As my business grows, I look for more detailed features like cash flow management and forecasting tools. I also consider whether the planner can scale with my business, and if it integrates well with other financial tools I use regularly.

Can These Planners Accommodate Both Personal and Business Finances?

You’re wondering if these planners can handle both personal and business finances. I’ve found that many versatile planners are designed with sections for both, making it easy to track everything in one place. I recommend choosing a planner that clearly separates personal and business categories, so you stay organized. This way, you get a thorough view of your finances without the hassle of using multiple tools.

Are Digital or Physical Planners More Effective for Entrepreneurs?

I get it—choosing between digital and physical planners can be tricky. I’ve found digital planners super effective because I can access them anywhere and easily update my finances on the go. Plus, they often sync with other tools. But if you love writing by hand, a physical planner helps me stay more engaged. Ultimately, I recommend picking what fits your workflow best—both can boost your business finances!

How Frequently Should I Update My Financial Planner for Accuracy?

I believe updating your financial planner regularly is key to staying accurate and on top of your finances. I recommend reviewing and updating it at least weekly, especially if your business is active or experiencing fluctuations. For less busy periods, bi-weekly or monthly updates work well. Consistency helps catch errors early and guarantees your plan reflects your current financial situation, giving you better control and peace of mind.

What Features Should I Look for in a Budget Planner for Startup Management?

Think of a budget planner as the compass guiding my startup through uncharted waters. I look for features like customizable categories, real-time tracking, and clear visual reports—these are my navigation tools. Automated expense tracking helps me avoid storms, while goal-setting features keep my eyes on the horizon. A mobile app guarantees I stay on course wherever I am. These features together keep my business steady and moving forward.

Conclusion

Choosing the right budgeting planner is like finding the perfect compass to navigate your business journey. It keeps you on course, helps you steer clear of financial storms, and guides you toward success. With the options I’ve shared, you’ll find a tool that fits your unique needs and style. Remember, a great planner won’t just track your money—it’ll empower you to chart a clear path to your entrepreneurial dreams.